The ‘ Morningstar Overall Rating’ is a quantitative assessment of a fund’s past performance-both return and risk-as measured from one to five stars, with one (1) being the lowest and five (5) being the best as on 31 st Octpber, 2021.

The value and income derived from investments may go down as well as up. Past performance is no guarantee of future results.

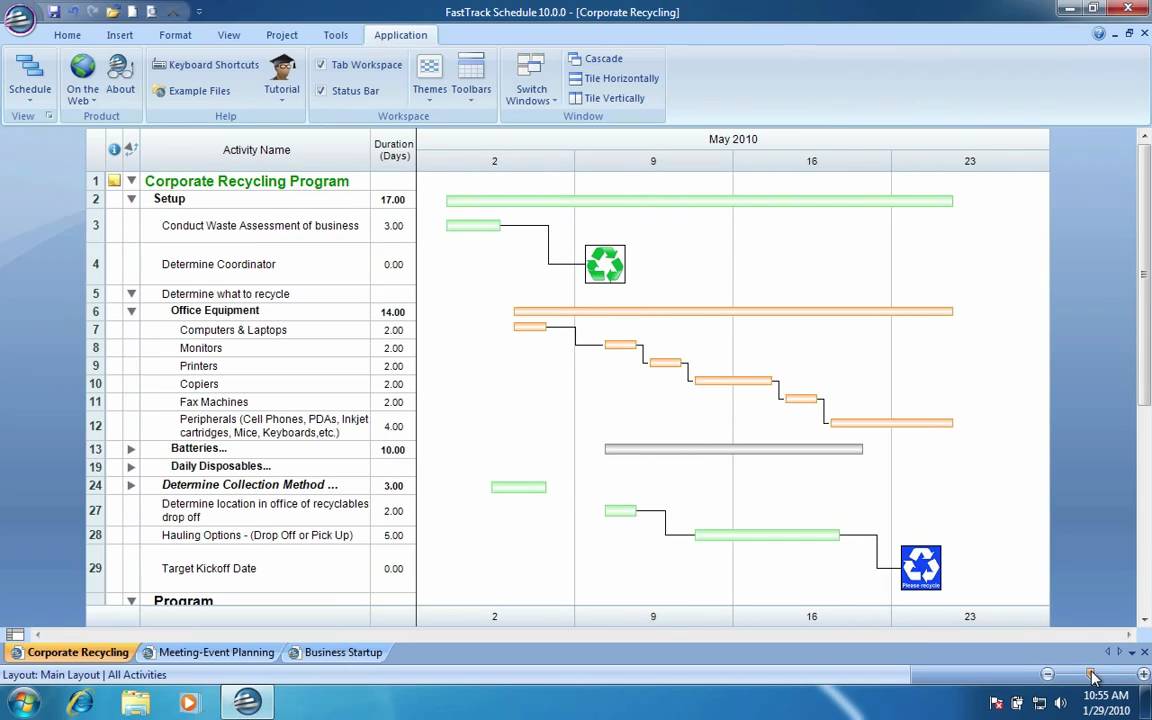

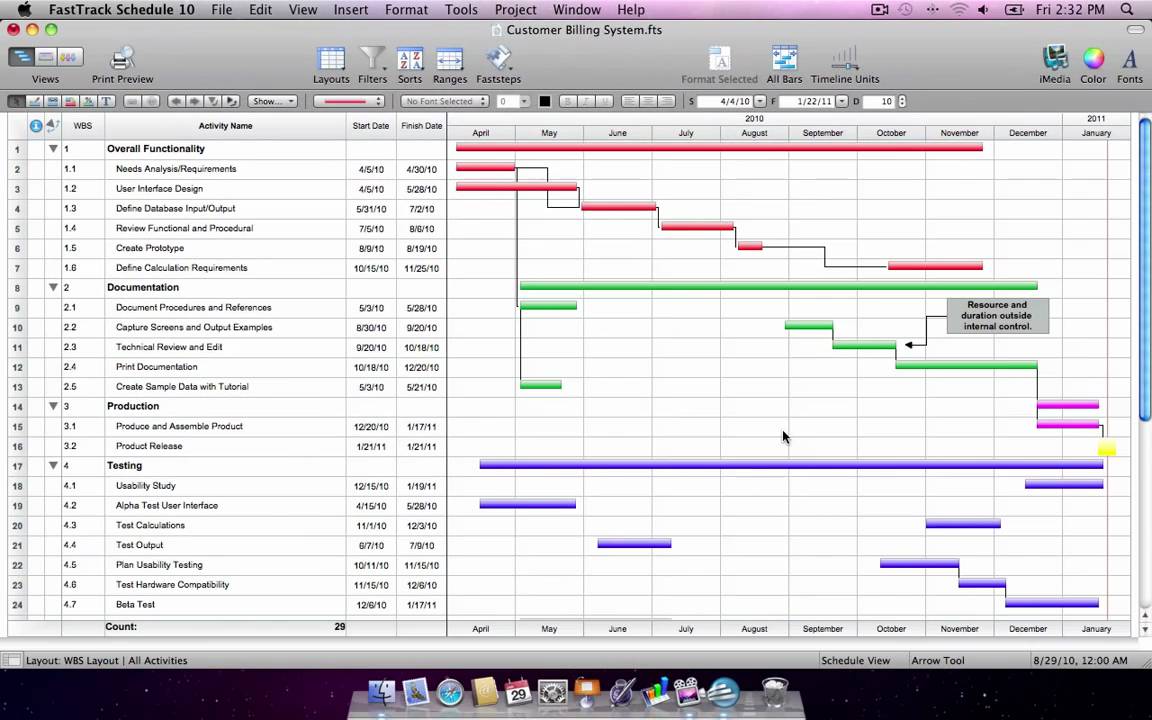

FASTTRACK SCHEDULE VERSION 3 FOR SALE PROFESSIONAL

Please verify all of the Information before using it and don’t make any investment decision except upon the advice of a professional financial adviser. Morningstar is not responsible for any trading decisions, damages or other losses related to the Information or its use. The information, data, analyses and opinions (“Information”) contained herein: (1) include the proprietary information of Morningstar and its content providers (2) may not be copied or redistributed except as specifically authorised (3) do not constitute investment advice (4) are provided solely for informational purposes (5) are not warranted to be complete, accurate or timely and (6) may be drawn from fund data published on various dates.

Rating and returns are as on 31 st October, 2021. Returns are 5-year compounded annualised growth rate (CAGR). The linked insurance products do not offer any liquidity during the first five years of the contract the policyholder will not be able to surrender/withdraw the monies invested in linked insurance products completely or partially till the end of the fifth year. Past performance is not necessarily indicative of future performance. In the unit-linked insurance policies, investment risk in the investment portfolio is borne by the policy holder. More details are available under the Premium Payment Options. **Single Pay, 5 Pay, and Regular Pay - are the three Premium Payment Term (the period for which you will invest in this policy) options available under this policy. You can check your fund and NAV performance here. As the value of the fund changes according to market conditions, the NAV value changes. The value of NAV is dependent on the value of the fund. NAV (Net Asset Value) of a ULIP is the total value of its holdings in the market on any given day (it is calculated daily).

Note: In case the Maturity Date is a non-working day for the Company or markets then the next working day’s NAV will be applicable. In case of revival of policies, the loyalty additions for previous years will be paid based on the Fund Value prevailing at the revival date. The additional units shall be created in different funds in proportion to the Fund Value at the time of credit. The loyalty additions increase by 0.02% (absolute) each year thereafter. If you choose the Regular Pay option for premium payment, 0.30% of Fund Value shall be added to your fund by the creation of additional units, at the end of every policy year starting from the 11th policy year.

0 kommentar(er)

0 kommentar(er)